As the economy recovers from the Covid crisis and we approach the November elections, Americans are confused about where the economy is heading. Stock prices are up sharply from their March lows, yet many small businesses and those who lost their jobs are in dire straits. Understanding where we stand in the economic cycle offers valuable context for what otherwise seems irreconcilable, particularly with respect to two key economic metrics: GDP and employment.

We'll likely see record employment and GDP growth right before Election Day, but the harsh reality is that the economy is still far behind where it was before Covid hit, and it will be years before either gets back to pre-Covid levels.

It's important to know that both GDP and jobs behave like bouncing balls during recession and recovery. In other words, the greater the drop, the bigger the rebound. Because we've recently seen the steepest ever declines in both of these measures, we should also see the fastest revivals on record.

That's simply par for the course. V-shaped recoveries — at least initially — are normal in the immediate aftermath of deep recessions.

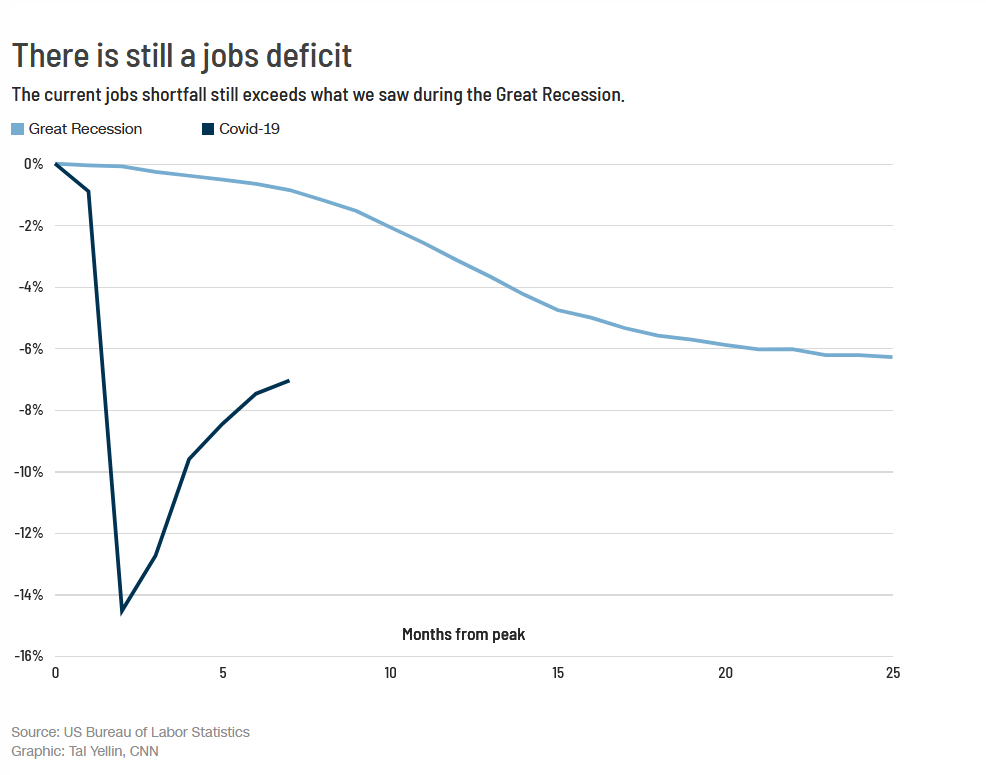

After peaking in February, nonfarm employment had plunged 14.5% by April 2020, a record pace of job losses, with the economy hemorrhaging 22.16 million jobs. Then, with the economy restarting and regaining 11.42 million jobs in five months, job growth rebounded by 8.8% (Chart 1, dark blue line). That's also one of the strongest paces of job gains on record, even though it still leaves a deficit of 10.74 million jobs — or 7% — well below February's peak.

These are big numbers that are hard to put in perspective, but it helps to compare them to the numbers we saw during the 2008 financial crisis. Recall that, at its low point in the wake of the Great Recession, employment had fallen 6.3% from its January 2008 peak (Chart 1, light blue line), with 8.71 million jobs lost. And yet, the current shortfall of 10.74 million jobs still exceeds that number.

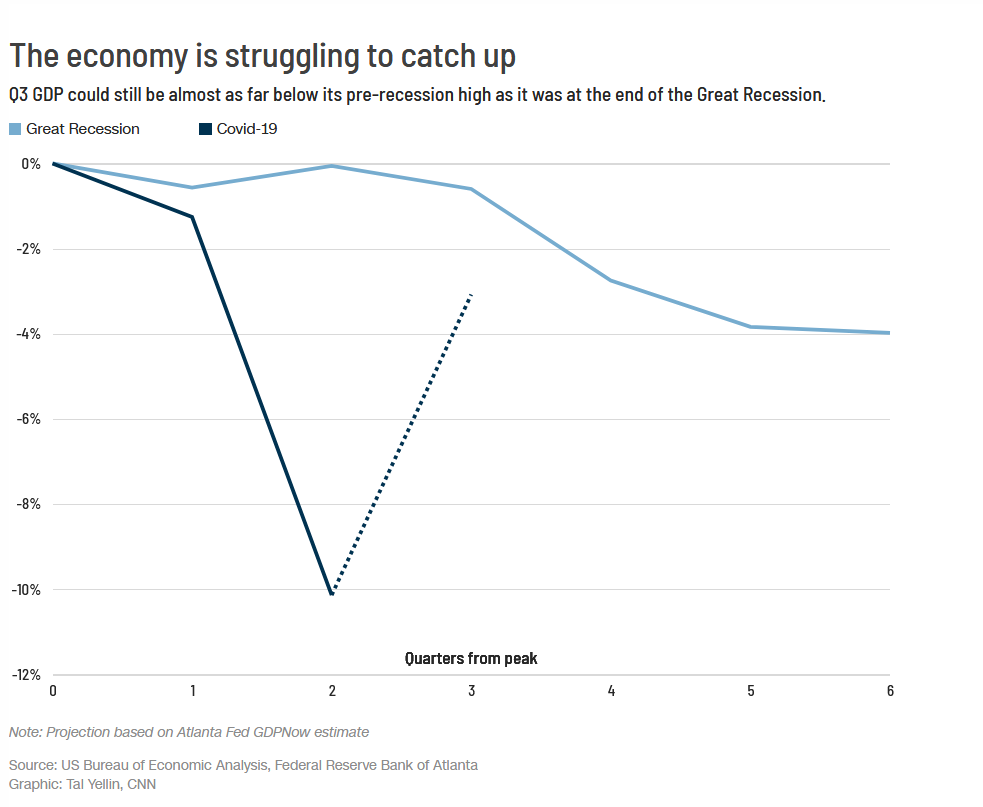

When it comes to Gross Domestic Product (GDP) — which measures the economy's total output — headlines have chronicled its 5% decline in Q1 2020, and then a 31.4% plunge in Q2 2020. It's clear that GDP collapsed, but these figures can be confusing, because it's standard US practice to express quarterly GDP growth as annualized growth rates. In reality, GDP shrank by 9% in Q2 2020, after declining by 1.3% in Q1 2020, leaving it 10.1% below its pre-recession high (Chart 2, dark blue line).

On the Thursday before Election Day, we'll get GDP data for Q3 2020. According to the most widely used estimate (the Atlanta Fed's GDPNow), it will surge at a record 35.3% annual rate in Q3 2020, and the headlines will seem impressive. But that would simply mean that GDP will have increased by 7.9% from the prior quarter, still leaving it 3.1% below its pre-recession high (Chart 2, dark blue dashed line). That's almost as low as the nadir of the Great Recession, when GDP was 4% below its pre-recession peak (Chart 2, light blue line). So again, despite what's likely to be the strongest annualized GDP growth on record, GDP could still be almost as far below its pre-recession high as it was at the end of the Great Recession.

In the face of the economic devastation wreaked by the recession, we wrote in June that "the market upturn makes perfect sense if you understand the historical relationship between stock price cycles and business cycles." But in many ways the recovery has gone "K-shaped," which is cause for concern, and helps explain the apparent contradictions.

The top branch of the K-shaped recovery is enjoyed by upper-income households, not the lower-income families who find themselves along the bottom branch of the K, bearing the brunt of job losses. Home prices have soared nationally given high demand and tight supplies of existing homes, coupled with record-low mortgage rates thanks to Fed policy, which has also helped to boost stock prices. This is good for upper-income households, but families with lower salaries aren't enjoying the benefits.

Owners of small businesses that are consumer-facing, like retail stores and restaurants, have also taken massive hits, with many permanently closing their doors as customers cut spending on services while diverting their purchases toward goods. Many analysts are getting misled about the overall economy's prospects, which remain hopeful, even as it is K-shaped.

But forward-looking data that covers both service-providing and goods-producing industries gives a better picture of where the overall economy is headed. The Weekly Leading Index offers an objective verdict on the future course of the economy, and its growth rate has kept improving, though more slowly.

Yes, the recovery is real, but it's clearly incomplete and also bifurcated. As strange as it sounds, this is why we're seeing record jobs and GDP growth off the bottom of the recession at the same time that we have a giant hole in the economy. While the pace of the revival could slow, meaning that it will take even longer to fill up that hole, the economy isn't about to backslide into a new recessionary hole.

Lakshman Achuthan and Anirvan Banerji are co-founders of the Economic Cycle Research Institute (ECRI). The opinions expressed in this commentary are their own.