Manufacturing activity in the region continued to decline overall, according to the firms responding to the January Manufacturing Business Outlook Survey. The survey's indicators for general activity, new orders, and shipments rose but remained negative. The employment index was little changed and continues to suggest mostly steady levels of employment overall. The price indexes indicate overall increases in prices, but both indexes are below their long-run averages. The survey's broad indicators for future activity declined, suggesting less widespread expectations for overall growth over the next six months.

Current Indicators Remain Weak

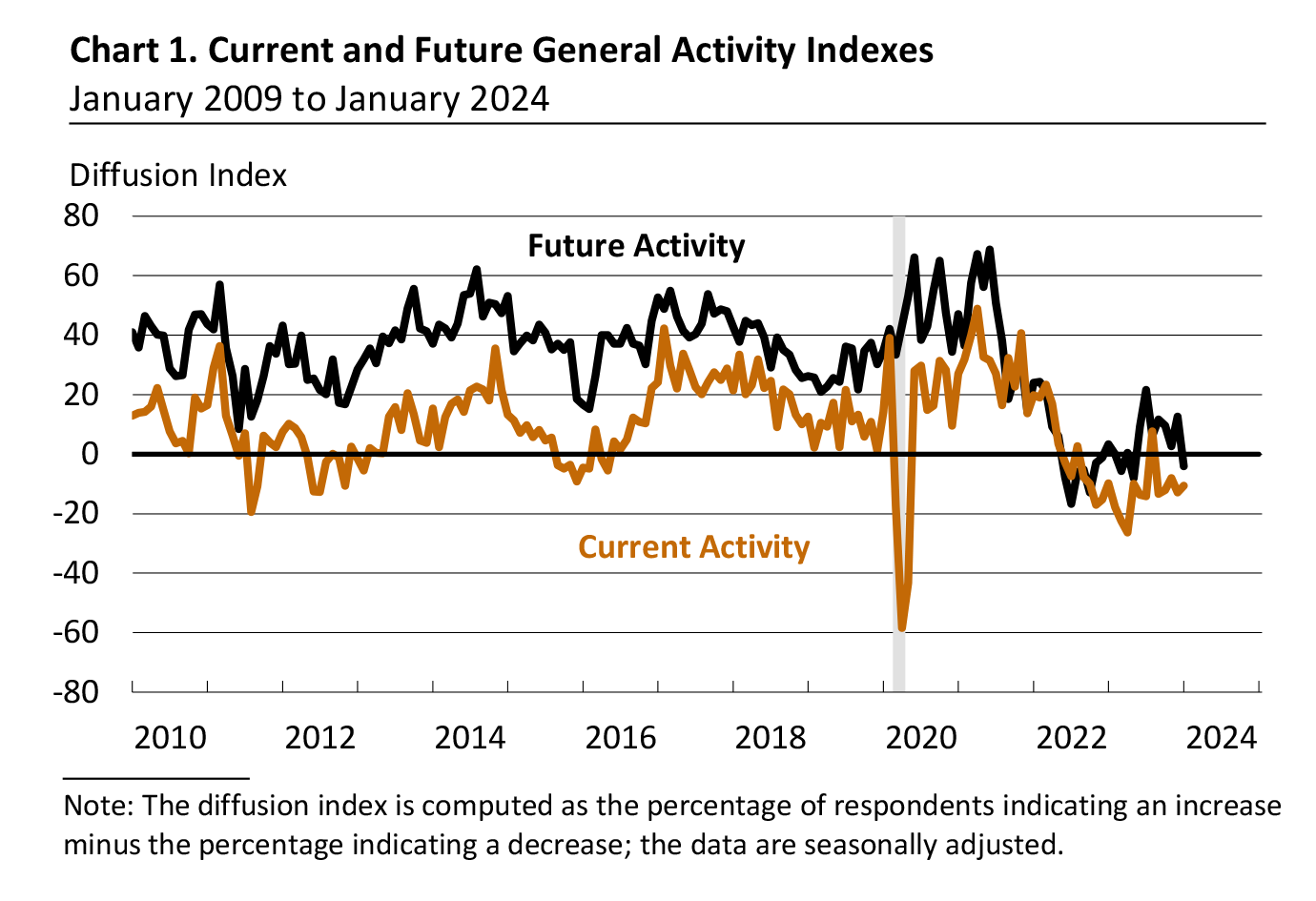

The diffusion index for current general activity ticked up from a revised reading of -12.8 in December to -10.6 in January (see Chart 1).* This is the index's 18th negative reading in the past 20 months. More than 26 percent of the firms reported decreases, exceeding the 16 percent reporting increases; 52 percent of the firms reported no change in current activity. The indexes for current new orders and current shipments both also rose in January but remained negative. The new orders index rose from -22.1 to -17.9, and the shipments index rose 5 points to -6.2.

On balance, the firms reported little change to employment. The employment index edged up less than 1 point to -1.8 in January. Similar shares of the firms reported decreases (12 percent) and increases (11 percent) in employment; most firms (75 percent) reported steady employment levels. The average workweek index remained negative but rose 5 points to -0.9.

Price Indexes Dip Below Long-Run Averages

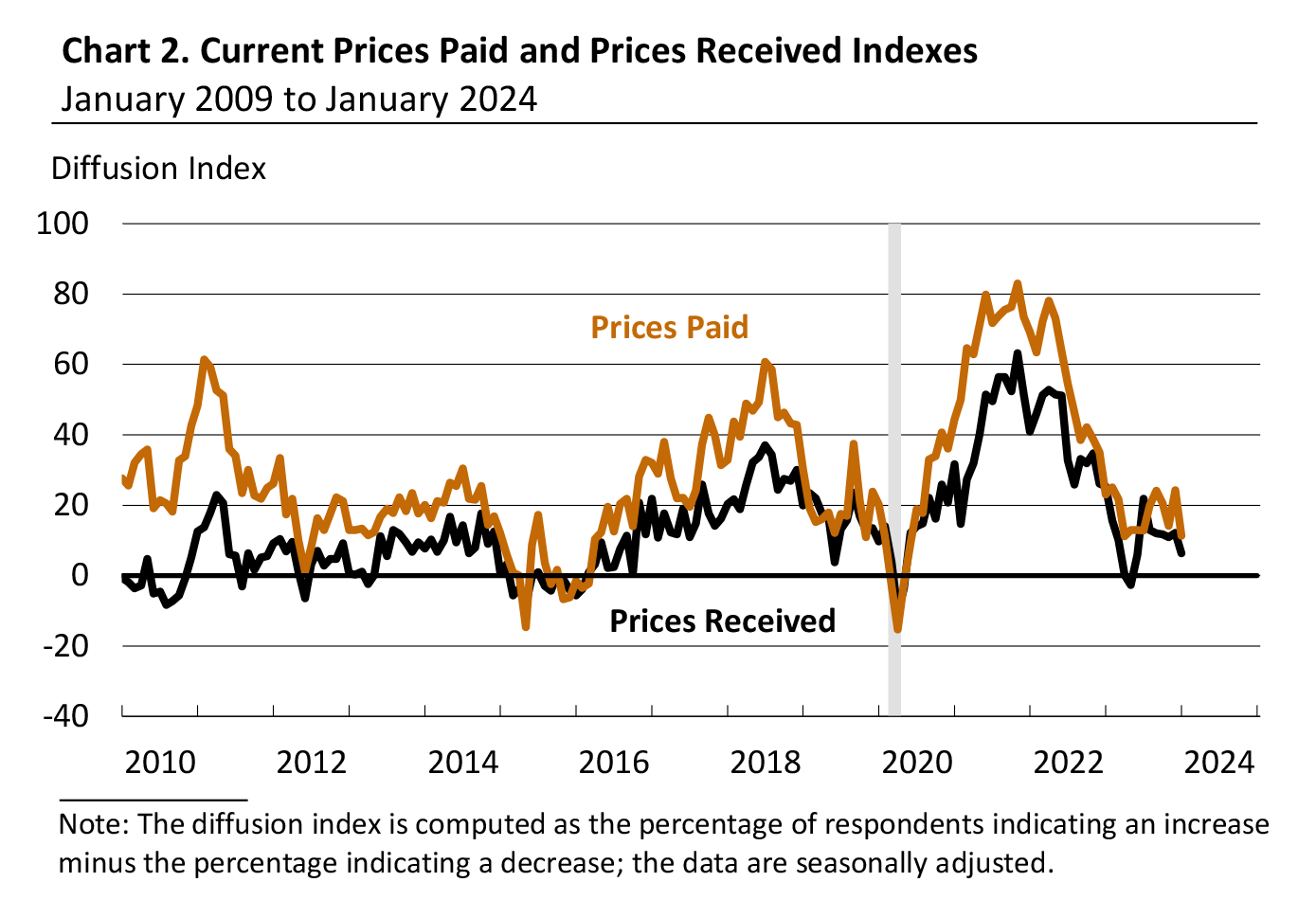

On balance, the firms reported overall increases in prices. However, most firms reported no change in prices, and both price indexes dropped below their long-run averages. The prices paid index fell 13 points to 11.3 in January (see Chart 2). More than 16 percent of the firms reported increases in input prices (down from 32 percent last month), while 5 percent reported decreases (down from 8 percent); 79 percent reported no change (up from 60 percent last month). The current prices received index declined 6 points to 6.3. Almost 8 percent of the firms reported increases in the prices of their own goods, 2 percent reported decreases, and 87 percent reported no change.

Firms Expect Smaller Cost Increases for 2024

In this month's special questions, the firms were asked about changes in their various input and labor costs over the past year and their expectations for changes in costs for the coming year. For all categories, the average percent change in costs expected for 2024 was smaller than the average percent change in costs reported for 2023. The respondents were also asked to rank the importance of various factors in setting prices. Demand for their own goods/services was the most important factor, followed by maintaining steady profit margins, wage and labor costs, and competitors' prices.

Key Future Indicators Decline

The diffusion index for future general activity fell from a revised reading of 12.6 in December to -4.0 in January, its lowest reading since May (see Chart 1). Nearly 26 percent of the firms expect a decrease in activity over the next six months, exceeding the 22 percent that expect an increase; 43 percent expect no change. The future new orders index declined 12 points to 9.7, and the future shipments index fell 15 points to 5.5. On balance, the firms expect mostly steady employment over the next six months, and the future employment index was essentially unchanged at 1.1. The future prices paid index increased 13 points to 34.4, while the future prices received index dropped 8 points to 20.7. Both future price indexes were below their long-run averages. The index for future capital expenditures rose 15 points to 7.5, its first positive reading since September.

Summary

Responses to the January Manufacturing Business Outlook Survey suggest overall declines in the region's manufacturing sector. The indicators for current activity, new orders, and shipments all remained negative. On balance, the firms continued to indicate overall increases in prices and mostly steady employment. The survey's broad indicators for future activity weakened, suggesting less widespread expectations for growth over the next six months.

* The survey's annual data revisions, which incorporate updated seasonal factors, were released on January 11, 2024. The full history of revised data is available here.

Special Questions (January 2024)

1. What were the percentage changes in costs for the following categories for 2023, and what do you expect they will be for 2024?

| |

2023

(Actual) |

2024

(Expected) |

| |

Average

(%)

|

Median

(%)

|

Average

(%) |

Median

(%) |

| Energy |

3.1 |

2–3 |

1.9 |

1–2 |

| Other Raw Materials |

2.6 |

3–4 |

2.2 |

2–3 |

| Intermediate Goods |

3.2 |

3–4 |

2.4 |

3–4 |

| Wages |

4.8 |

4–5 |

3.0 |

3–4 |

| Health Benefits |

5.4 |

3–5 |

4.6 |

3–4 |

| Nonhealth Benefits |

2.6 |

2–3 |

2.2 |

1–2 |

| Wages + Health Benefits + Nonhealth Benefits |

5.6 |

4–5 |

4.4 |

3–4 |

| Note: Respondents selected ranges of percentage changes. The average percent change is calculated using the midpoints of the ranges of each answer option. |

2. Currently, when you think about setting the prices of your goods/services, how important to you are the following factors in making those decisions?

| |

Weighted Average*

(%)

|

| Your competitors' prices |

73 |

| The strength of demand for your most important

good(s) or service(s)

|

81 |

|

Your wages and labor costs (including benefits)

|

76 |

|

Your nonlabor costs, such as energy prices, materials prices, transportation costs, rent, etc.

|

68 |

| Maintaining steady profit margins (for price over costs) |

78 |

| Interest rates, borrowing rates, and the cost of capital |

47 |

| Problems with your supply chains, such as bottlenecks and

product shortages

|

47 |

| The overall rate of inflation in the U.S. economy,

as measured by the Consumer Price Index

|

51 |

| Other |

59 |

| * Respondents reported importance on a scale of 1 (least important) to 5 (most important). The weighted average gives 1 a weight of 0; 2 a weight of 0.25; 3 a weight of 0.5; 4 a weight of 0.75; and 5 a weight of 1. |