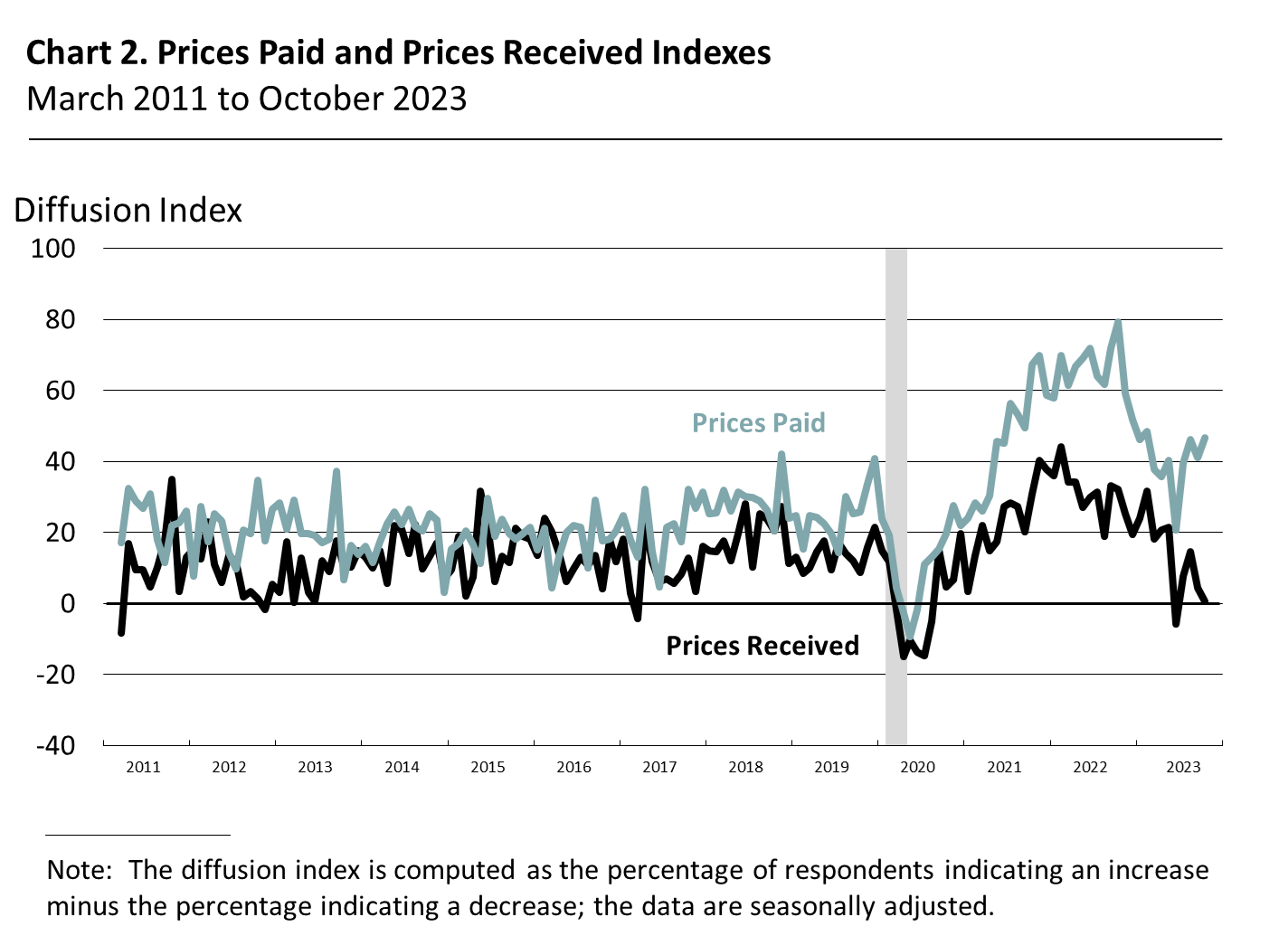

Nonmanufacturing activity in the region remained weak overall, according to the firms responding to the October Nonmanufacturing Business Outlook Survey. The survey's current indicators for general activity at the firm level and for sales/revenues edged up but remained negative. Meanwhile, the index for new orders fell further into negative territory. The survey's index for prices paid increased this month, while the index for prices received was flat. Overall, the respondents expect growth over the next six months at their own firms, and optimism was more widespread this month.

Current Indicators Remain Weak

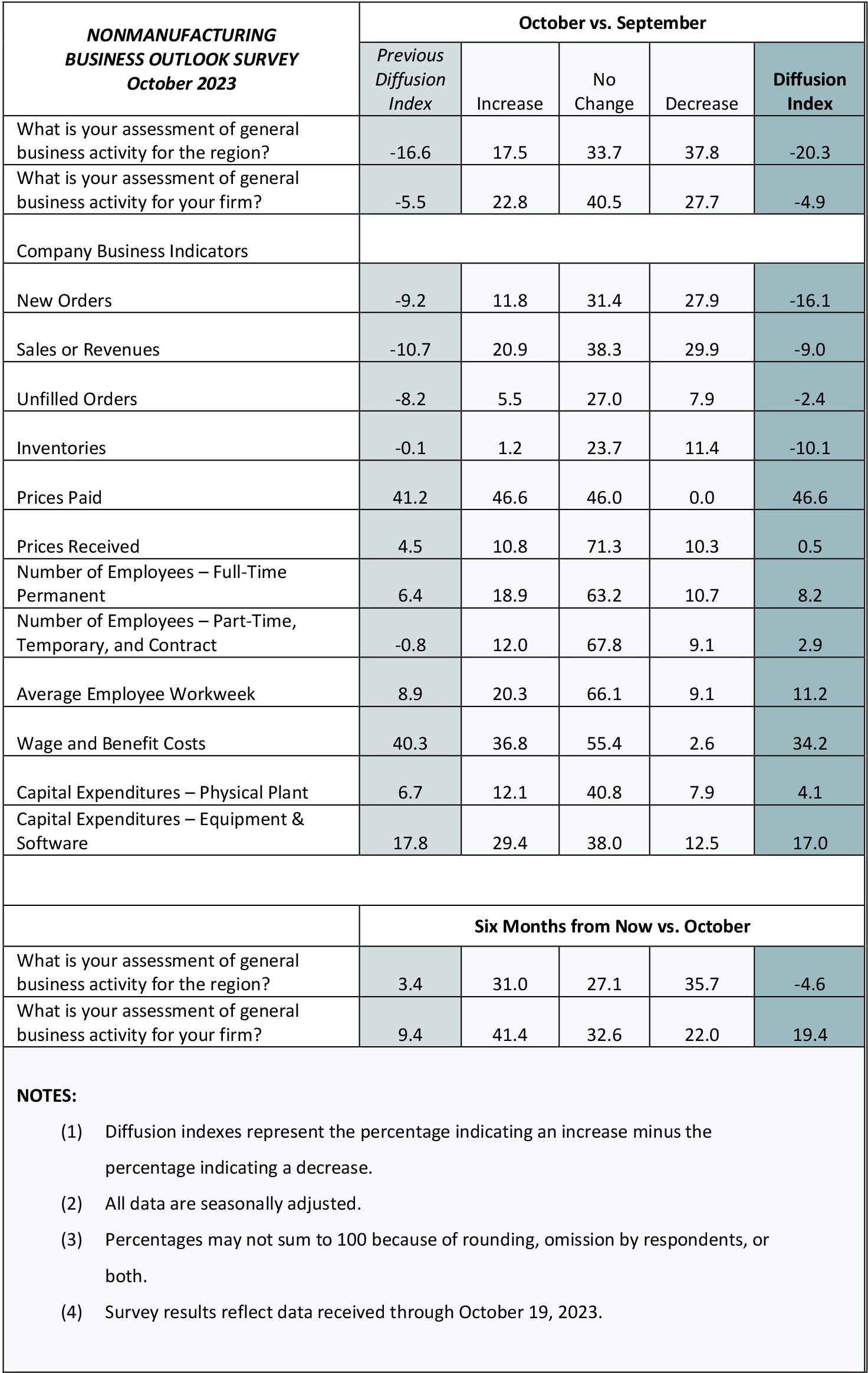

The diffusion index for current general activity at the firm level edged up from -5.5 last month to -4.9 in October, remaining negative for the third consecutive month (see Chart 1). Almost 23 percent of the firms reported increases, while 28 percent reported decreases. The sales/revenues index also recorded its third consecutive decline but inched up 2 points to -9.0. Nearly 21 percent of the firms reported increases in sales/revenues, while 30 percent reported decreases. The new orders index declined 7 points this month to -16.1, undoing its increase from last month and registering its fifth consecutive negative reading. Almost 12 percent of the firms reported increases in new orders, less than the 28 percent that reported decreases. The regional activity index declined 4 points to -20.3 this month.

Firms Report Overall Increases in Employment

The firms reported overall increases in full- and part-time employment this month. The full-time employment index remained positive at 8.2 in October, up from 6.4 last month. The share of firms reporting increases in full-time employment (19 percent) exceeded the share reporting decreases (11 percent); most firms (63 percent) reported no change. After recording two consecutive months of slightly negative readings, the part-time employment index increased to 2.9 this month. Most firms (68 percent) reported steady part-time employment, while 12 percent of the firms reported increases and 9 percent reported decreases. The average workweek index rose 2 points to 11.2.

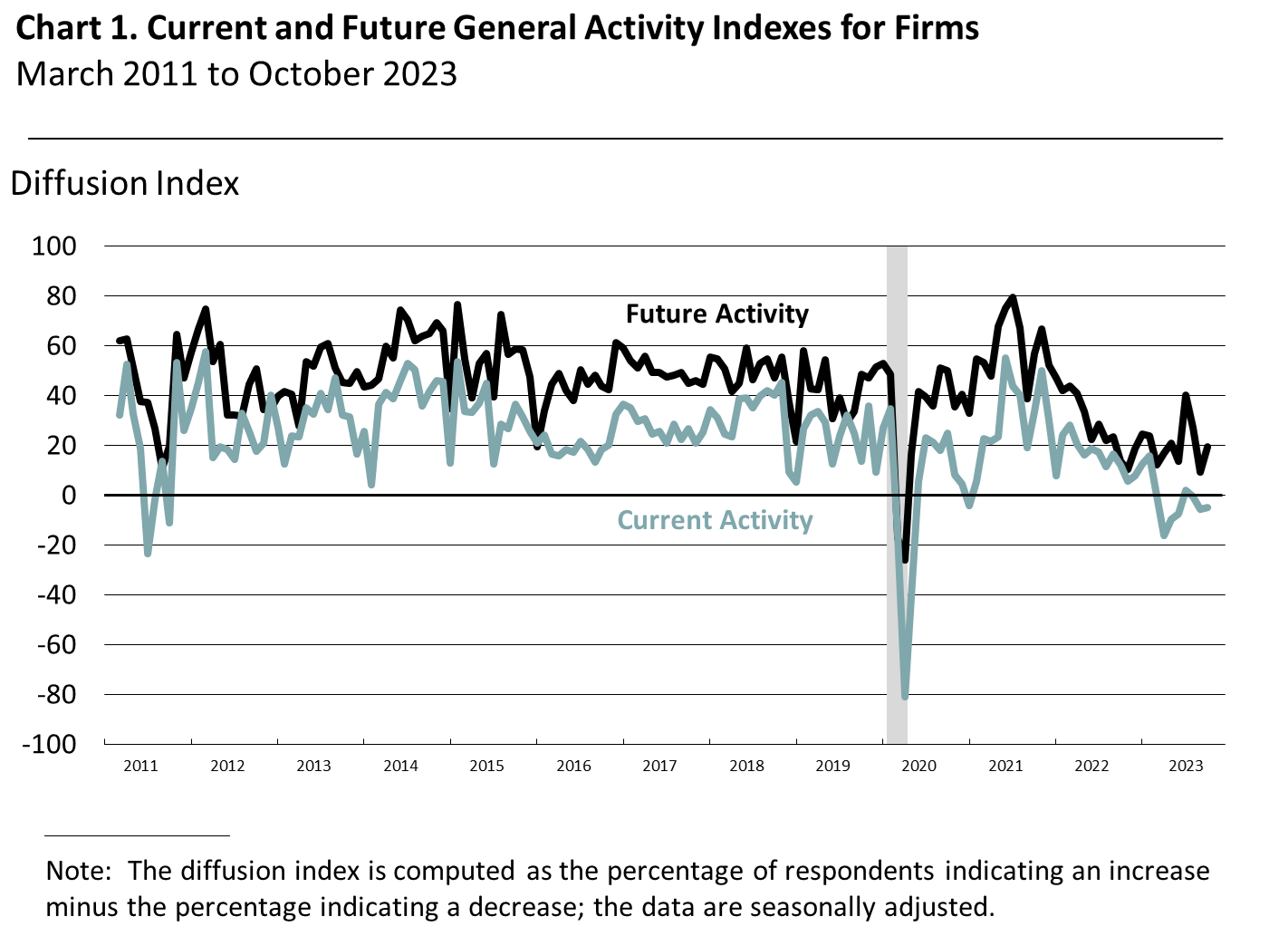

Firms Continue to Report Increases in Prices Paid

Price indicator readings suggest widespread increases in prices for inputs and steady prices for the firms' own goods and services. The prices paid index increased 5 points to 46.6 in October (see Chart 2). Almost 47 percent of the firms reported increases in prices paid, 46 percent reported steady input prices, and no firms reported decreases. Regarding prices for the firms' own goods and services, the prices received index fell 4 points to 0.5. The share of firms reporting increases in prices received (11 percent) narrowly exceeded the share reporting decreases (10 percent). Over 71 percent of the firms reported no change in prices received.

Firms Anticipate Lower Capital Expenditures Next Year

For this month's special question, nonmanufacturers were asked about their plans for different categories of capital spending for the upcoming year. On balance, a larger share of firms expects a decrease in capital expenditures in 2024 than an increase. More than 22 percent of the respondents expect to increase total capital spending, while 31 percent expect to decrease capital expenditure spending. Almost 47 percent of the firms expect the same level of capital expenditure over the next year. Overall, the firms expect lower capital spending for all categories except software.

Respondents Anticipate Growth at Own Firms

The diffusion index for future activity at the firm level increased from a reading of 9.4 in September to 19.4 this month (see Chart 1). Nearly 41 percent of the respondents expect an increase in activity at their firms over the next six months (up from 33 percent), compared with 22 percent that expect decreases (down slightly from 23 percent) and 33 percent that expect no change (down from 41 percent). However, the future regional activity index fell 8 points to -4.6, its first negative reading since April.

Summary

Responses to this month's Nonmanufacturing Business Outlook Survey suggest weak nonmanufacturing activity in the region. The indicators for firm-level general activity, sales/revenues, and new orders all remained negative. The prices paid index continued to suggest price increases for inputs this month. The future firm-level activity index suggests more widespread optimism for growth over the next six months.

Special Question (October 2023)

| Comparing 2024 with 2023, do you expect capital expenditures to be higher, the same, or lower for each of the following categories? |

| |

Higher

(% of reporters)

|

Same

(% of reporters)

|

Lower

(% of reporters)

|

Diffusion

Index |

| Software |

35.6 |

46.7 |

17.8 |

17.8 |

| Noncomputer equipment |

22.7 |

46.7 |

29.5 |

-6.8 |

|

Energy-saving investments

|

25.6 |

40.0 |

28.2 |

-2.6 |

|

Computer and related hardware

|

22.2 |

53.3 |

24.4 |

-2.2 |

| Structure |

17.8 |

46.7 |

19.4 |

-1.7 |

| Other |

0.0 |

77.8 |

22.2 |

-22.2 |

|

Total capital spending |

22.2 |

46.7 |

31.1 |

-8.9 |

Summary of Returns (October 2023)